Do you need money fast?

Fast Loan Advance offers quick payday loans online.

You can apply easily and get approved quickly, with the money in your account within 24 hours.

They usually ask for a bank account, proof of income, and age.

But be careful, some online lenders might charge high interest rates, especially if you have bad credit.

Looking for Fast Loan Advance reviews?

Discover if it’s legit or a scam in our comprehensive review.

Get the facts before you borrow!

What Is Fast Loan Advance?

Fast Loan Advance is a quick way to get a short-term loan for small amounts of money.

It’s good if you need cash fast and don’t want to wait for a regular loan.

Before you choose a lender, read reviews and compare fees and interest rates.

Fast Loan Advance uses your information to decide if you qualify for a loan quickly.

They offer loans from $1,000 to $10,000 with low interest rates starting at 8%.

How Does Fast Loan Advance Work?

Fast Loan Advance is a company in the US that gives people lines of credit and short-term loans.

They approve applications quickly and you can apply online.

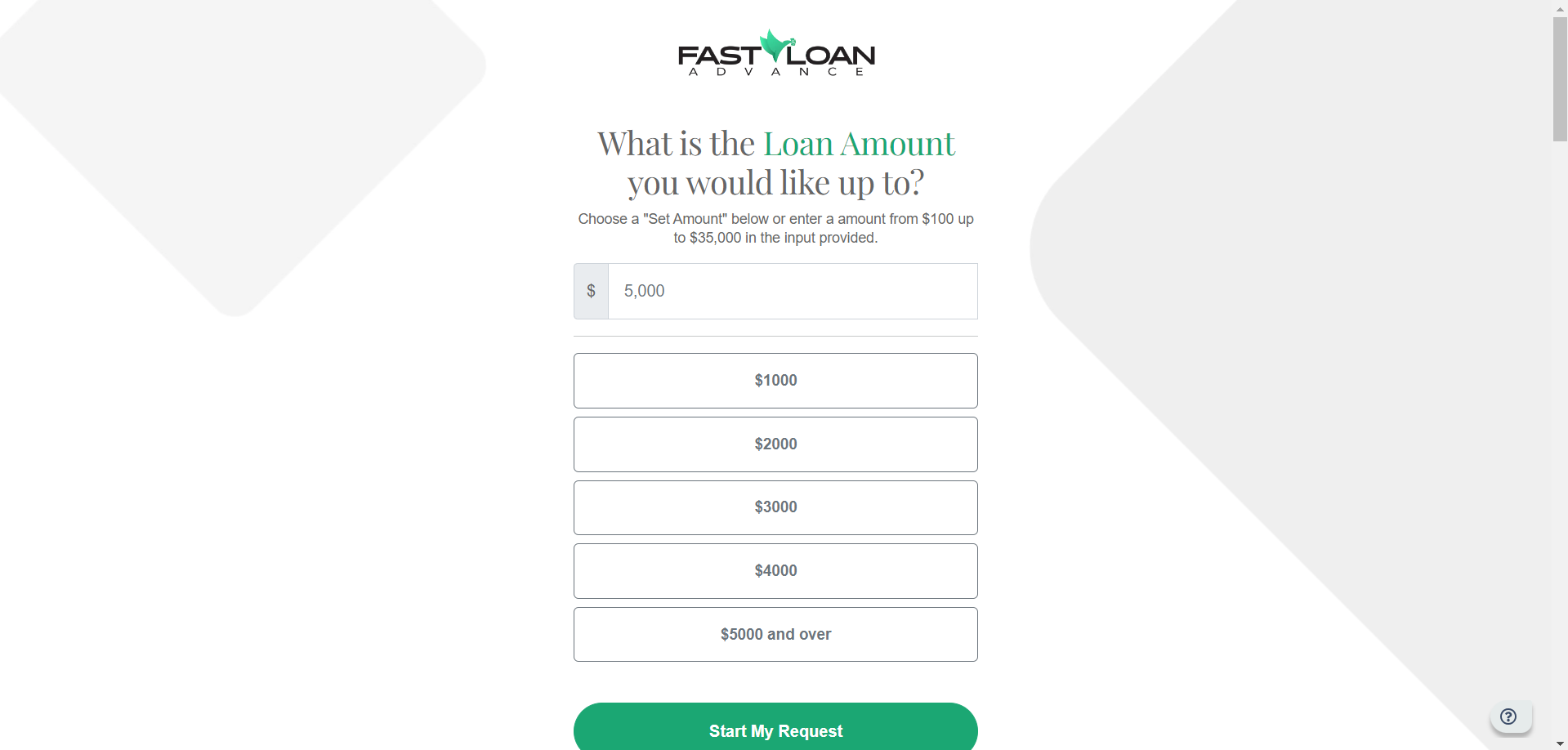

You can borrow from $100 to $10,000.

To get a loan, you need to be at least 18 years old, have a job that they can check, and have a bank account.

You also need to give them some personal information like your address and social security number.

They use a system to check if you can pay back the loan. If you’re approved, the money will be put into your bank account within a day.

You have to pay back the loan, plus interest and fees.

The amount you borrowed and how much you can pay back will decide when you need to pay back the loan.

How Do you Borrow from Fast Loan Advance?

Fast Loan Advance gives people quick access to cash through short-term loans.

Here’s how it works:

- Application: You start by filling out an online form on their website. You need to give personal, income, work, and bank account details.

- Approval: They review your application to see if you qualify. If you do, they tell you how much you can borrow, the interest rate, and when you need to pay it back.

- Get the money: If you agree to the loan, they put the money in your bank account. It might take some time to show up.

- Repayment: You have to pay back the loan, plus interest and fees, by your next paycheck. They might take the money directly from your bank account.

- Loan amounts: You can borrow from $100 to $1,000, depending on your situation and the rules in your state.

- Eligibility: You need to be at least 18 years old, have a job, and a bank account. You might also need to show proof of where you live, your income, and who you are.

- Loan term: These loans are usually meant to be paid back when you get your next paycheck. If you can’t pay it back in time, you might have to pay more fees.

- Late payments: If you can’t pay back the loan on time, they might charge you extra fees.

- Customer support: They have people you can talk to if you have questions or problems. Before you get a loan, make sure you can pay it back on time, as these loans can have high fees.

Interest Rates, Fees, and Terms for Fast Loan Advance

Fast Loan Advance doesn’t give out loans themselves, but they can give you an idea of what to expect from their lending partners.

The interest rates can vary depending on how much you borrow.

For example, if you borrow $1,000, the interest rate might be 24%, but if you borrow $10,000, it might be 8%.

Besides interest, the lending partners might also charge other fees like processing fees or fees for paying late.

Advantages and Disadvantages of Fast Loan Advance

Pros

- Instant Review & Approval

Fast Loan Advance.com uses advanced algorithms to quickly assess your eligibility for a loan and provide feedback. They scan their advertiser’s database to find a partner willing to lend to you based on your information.

- Accessibility

Compared to traditional banks, Fast Loan Advance.com has simpler eligibility requirements, making it easier to get a loan with less paperwork.

- Flexible Loan Options

Fast Loan Advance.com offers various loan options to meet different borrower needs, including payday loans, installment loans, or short-term loans, as long as they have ads in these categories.

- Convenience

Fast Loan Advance.com offers convenience by allowing you to complete your transactions from home without visiting a bank or filling out paperwork. Their quick and easy application process enables borrowers to request loans online.

Cons

- High-Interest Rates

Fast Loan Advance.com may charge higher interest rates, especially for smaller loans. It’s important to review their rates and terms carefully to make sure they work for you.

- Possibility of Predatory Practices

Some payday loan sites have been known to use unfair practices, like unclear terms and hidden fees. It’s best to use a trusted service like Fast Loan Advance if you need quick cash.

Fast Loan Advance Reviews: Legit or Scam?

Fast Loan Advances can provide money quickly when you need it, but not all lenders are trustworthy.

It’s important to research lenders before applying.

Fast Loan Advance is a direct lender that offers lines of credit and short-term loans.

They operate in California, Oregon, and Washington, following OLA guidelines.

To qualify, you need to meet certain requirements and have a steady income.

Loans are usually approved within 24 hours, with amounts ranging from $100 to $2,000 and repayment terms of 3 to 12 months.

They also offer lines of credit with limits from $500 to $5,000 and durations of 6 to 18 months.

Conclusion

Fast Loan Advance offers quick and easy access to money with simple requirements, fair rates, and good customer support.

They use a secure online system to protect your information.

It’s important to know that the lending partners set the interest rates and terms.

Research before applying and carefully review the terms.

Also Read: