LoansUnder361 helps people borrow money for personal needs.

They don’t lend money themselves but show options from other lenders.

These loans can have interest rates between 5.99% and 35.99%.

It’s important to research before choosing a lender.

In this article, discover if Loans Under 36 is trustworthy with our in-depth review.

Learn about their lending process, interest rates, and customer experiences.

What is LoansUnder36?

LoansUnder36 is an unsecured personal loan marketplace launched in 2012, offering both short-term and long-term loans.

As a marketplace, it shares your information with up to five lenders.

While it lacks a BBB rating, review sites like Consumers Advocate and The Credit Review rate it well, though Trustpilot gives it a 2.7 out of 4.

LoansUnder36 affiliates provide fast service, with loans sometimes received as quickly as the next business day, making them useful for emergencies like medical bills or car repairs.

What Types of Loans Does LoansUnder36 Provide?

LoansUnder36 helps you find personal loans from different lenders.

You can borrow as little as $500 or up to $35,000, and pay it back over two months to six years.

The interest rates range from 5.99% to 35.99% (as of May 23, 2023), depending on the lender and your credit score.

You’ll get offers from more than 100 lenders, and you can choose the one that works best for you.

You can use the loan for things like paying off credit card debt, fixing your car, or medical bills.

Keep in mind, LoansUnder36 is not a lender, so you’re not obligated to accept any offers you receive.

Is Good Credit Necessary to Apply for a Loan Through LoansUnder36?

To get a loan from LoansUnder36, you must be at least 18 years old and a U.S. citizen or permanent resident.

While there’s no minimum credit score required, having a higher score can get you better loan offers.

It’s also helpful to have a bank account with direct deposit.

They’ll look at your income, debts, and other typical loan requirements when considering your application.

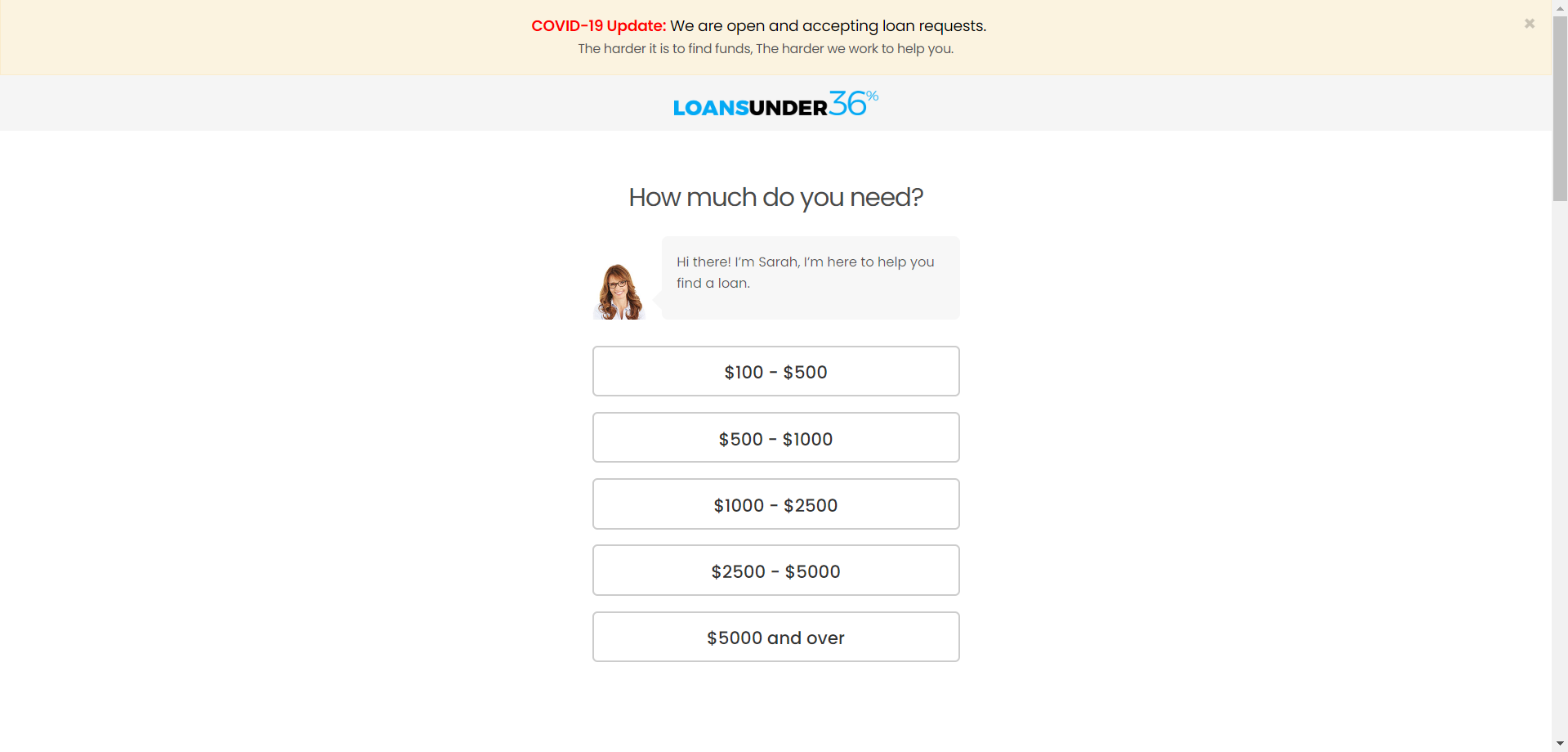

How to Apply for a Loan with LoansUnder36

Applying for an online loan with LoansUnder36 is easy.

You fill out a form online with personal details like your bank information, driver’s license number, phone number, income source, and Social Security number.

By applying, you agree to their terms, which may include sharing your information and a possible credit check.

You’ll get a quick response, with some people getting approved funds the next day.

After getting offers, you finalize your loan agreement with your chosen lender.

Is LoansUnder36 Legit?

Yes. LoansUnder36 is a trustworthy place to find personal loans from different lenders.

If you have any questions about loans or lenders, you can contact their customer support by phone or email.

Conclusion

LoansUnder36 is a good option if you need a personal loan.

Their process is simple and lets you choose your lender.

However, it’s smart to compare different lenders to find the best terms for your loan.

Make sure to check things like monthly payments and fees before you decide.

If you want to explore more loan options, take a look at our list of the best personal loans.

And always do your research before you sign up for anything.