Is Migo Loan a Legit Lender or a Loan Shark in Disguise?

In today’s digital world, you can easily get quick loans from apps on your phone.

Migo is a well-known lending app in Africa and Southeast Asia.

It says it can give you money fast and let you pay it back flexibly.

But is Migo a real lender, or is it secretly a loan shark? Let’s find out by looking closely at both possibilities.

Who Is The Owner Of Migo Loan?

First, let’s find out who owns Migo loans.

This will help us check if the business is real.

Remember the MMM story? It was a scam that cheated many Nigerians out of their money.

So, we need to know who’s running Migo.

Migo is based in San Francisco, California, and works in Nigeria and Brazil.

The owners are Ekechi Nwokah and Kunle Olukotun.

Kunle Olukotun is a professor at Stanford University.

He’s known for creating computers that can do lots of things at once.

Ekechi has worked in the industry for 20 years.

He knows a lot about building computer systems.

They started Migo to let places in new markets give credit to people without smartphones.

Migo started in 2014 and has been helping people since then.

“The owners of Migo haven’t done anything wrong.

They’re both doing great in tech.

So, it’s likely that Migo is real. Let’s learn more about it.

How Does The Migo Loan Work?

Migo Loan connects people who need to borrow money with those who want to lend it.

It’s not just like any other lending platform; it’s designed to be clear and reliable.

Migo offers loans for all kinds of businesses, from small shops to big companies.

You can request a loan with set interest rates and repayment plans.

Migo Loan doesn’t ask you to pay any fees for using its service.

Joining Migo and borrowing money is completely free.

How Much Can I Borrow From Migo?

Typically, Migo lets you borrow anywhere from five hundred nairas (N500) to five hundred thousand nairas (N500,000).

They usually begin with smaller loans and increase the amount as you become more comfortable with the system.

As a new customer, you can borrow from ten thousand naira at the least to fifty thousand naira at the most.

The great thing is, that you don’t need any collateral or a guarantor to get a loan from Migo.

You have the option to pick between personal and business loans, and the amount you can borrow depends on your credit score and other factors.

Migo is a great place to start if you need money to start your business.

And if you want a personal loan with low interest rates, Migo is one of the best options.

What Happens If I Don’t Pay My Migo Loan?

The Migo loan is a loan with low interest and no fees that lets you borrow the amount you need.

If you don’t pay it back on time, you’ll get charged a late fee and your credit score will drop.

Migo usually charges between 5% to 25% interest.

Not paying on time can make the interest rate go up, but if you pay on time, your interest rates can go down, and you might be able to borrow more.

Migo can also take legal action against you if you don’t pay back your loan.

It’s important to pay your loans on time to avoid extra fees and legal trouble.

Paying back your loan quickly helps Migo give loans to more people.

If you need more time to pay, extending your loan is better than not paying.

It keeps your Migo credit history good.

Is Migo Loan Registered With The CBN?

Yes, Migo is registered with the Central Bank of Nigeria, allowing them to legally lend money without interest worries.

However, if you default, you’re solely responsible for repayment with no penalties or collateral needed.

Being CBN registered validates their legitimacy, unlike unregistered companies resorting to fake messages and threats.

Does Migo Loan Have An Office?

Yes, they have an office.

Migo Loan is an online lending company that gives personal, company, and business loans on its website.

But they also have a real office where customers can go if they need to.

There are more offices in different places in the country, but the main one is in Ikoyi, Lagos, Nigeria.

Migo’s main office is at 3B Lawal Road, Ikoyi, Lagos State.

How To Get Started On Migo

If you want to try out Migo but don’t know where to start, here’s how to get going on their website.

First, go to their website and sign up for an account.

Click on “get a loan” and enter your phone number.

You’ll get a 6-digit PIN sent to your phone to confirm it’s you.

Then, choose how much money you want to borrow and enter your bank details.

This is where your loan will be deposited.

After that, add your debit card details.

This is how you’ll pay back your loan.

Once you’ve done all that, your loan application is good to go! Just sit back and wait for the money to hit your account.

If you prefer, you can use the Migo loan USSD code *561# instead of the website.

Just make sure all your info is correct.

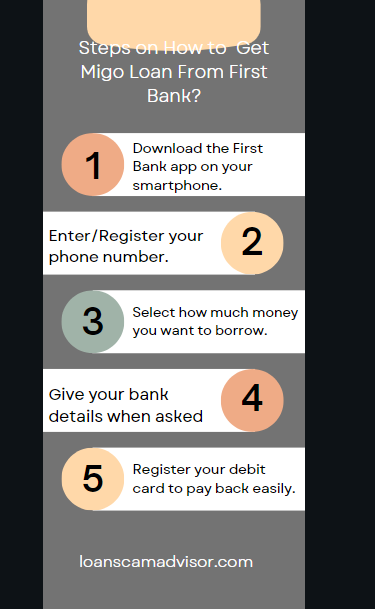

How Do I Get A Migo Loan From First Bank?

To get aMigo loan from First Bank, just use their mobile app. It’s easy:

1. Download the First Bank app on your smartphone.

2. Enter/Register your phone number.

3. Select how much money you want to borrow.

4. Give your bank details when asked. That’s where your loan will go.

5. Register your debit card to pay back easily.

Conclusion

A mortgage loan is a useful tool for managing your money.

It lets you borrow cash without needing to put up anything as security, and you can pay it back in ways that suit you.

You might worry if Migo loan is trustworthy.

Well, this article clears that up – yes, the Migo loan is legit.

It’s not a scam, but like any online service, it has its good points and bad points.

To help you decide if a Migo loan is right for you, we’ve listed a few of each.

So, what do you think? Would you borrow from Migo?

ALSO READ