Have you ever figured out how long you could pay your bills if you didn’t earn any money?

For most Americans, it’s less than a month.

In 2020, 70% of people in a survey said they would struggle to keep up with their bills if they didn’t get paid for an extra week.

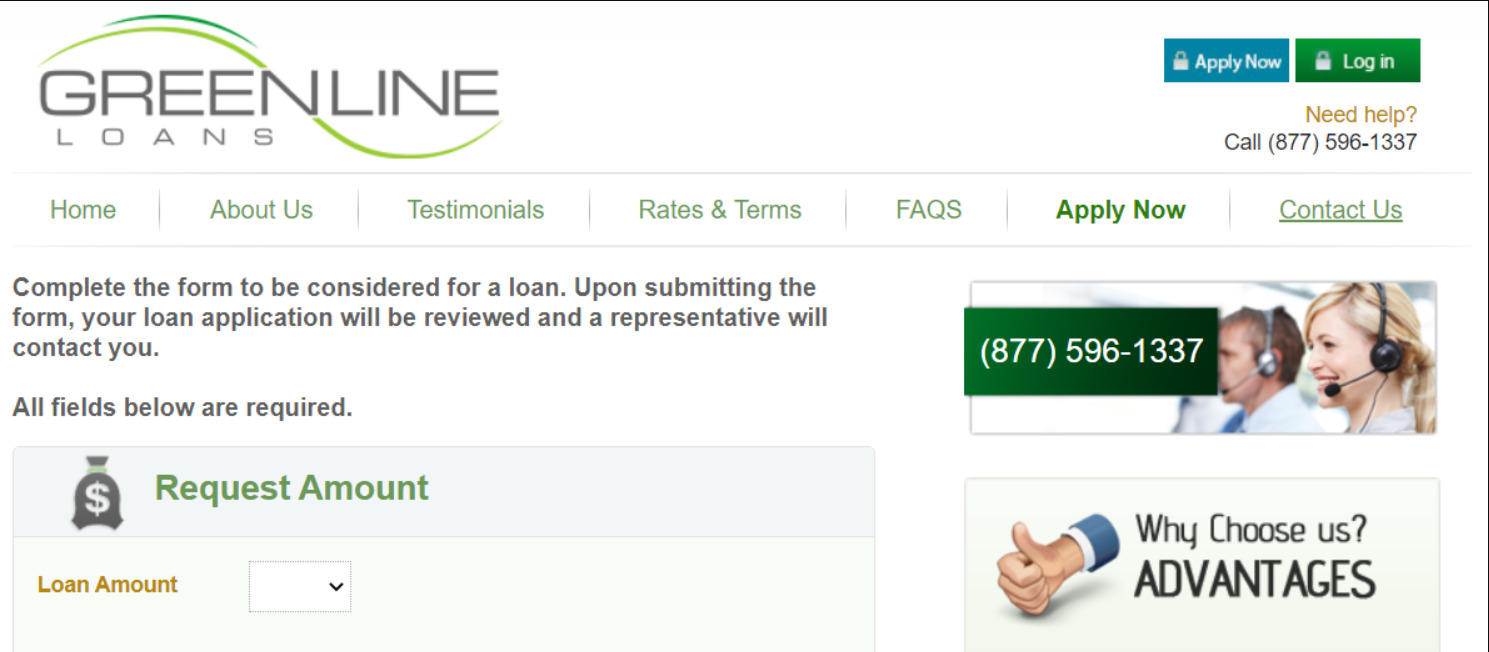

This is why people need short-term loans like the ones Greenline Loans offers.

But before you borrow from them, it’s important to do your research.

Greenline Loans: Legit or Scam?

Discover if Greenline Loans is a legitimate lending option or a potential scam.

Read our review to make an informed decision before borrowing.

What is Greenline Loans?

Greenline Loans gives short-term loans to people with bad credit who need money quickly for emergencies like car repairs or medical bills.

They don’t check credit scores and provide funds fast.

But their loans are expensive, and they advise considering other options like borrowing from family or using savings, which might be cheaper.

Is Greenline Loans Licensed?

Greenline Loans does business in Wisconsin without a state lending license.

They’re a tribal lender connected to the Lac du Flambeau Band of Chippewa Indians, which gives them special legal protection.

This protection means they can charge higher rates than allowed by states and are hard to sue.

They mention their tribal connection in their disclaimers but might not explain what it means for borrowers.

Typical Loan Terms

Tribal lenders are now sharing fewer details about their loan terms upfront, often waiting until borrowers receive their loan documents.

However, by checking previous versions of Greenline Loans’ website, borrowers can find information like:

- Loans ranging from $100 to $300

- An interest rate of about 762.33%

- Payments every two weeks

- Repayment periods of a few months, depending on the loan amount

- No fees for paying early

- A late fee of up to 10% after five days

- Extra fees for insufficient funds

In example, a $300 loan at 762.33% APR would lead to $633.53 in interest alone, more than double the original amount.

While Greenline Loans might have removed this information from their site, it’s likely that their rates haven’t changed.

Online Reputation

The Better Business Bureau (BBB) is a good place to check a company’s reputation online.

They filter out fake reviews and use customer complaints to rate businesses.

Surprisingly, Greenline Loans doesn’t have much information on its BBB page.

Despite being in business for almost ten years, there are only three reviews and no complaints.

The BBB redirects visitors to Quick Help Loans, which now includes Greenline Loans.

However, Quick Help Loans’ page also has limited information, with only two reviews (one positive and one negative) and six complaints.

Some complaints mention confusion about the lender’s identity due to changes by the Lac du Flambeau Band of Chippewa Indians, who own Greenline Loans.

Most complaints are about high borrowing costs and billing and collections processes.

Despite this, Quick Help Loans has an A- rating because they address complaints well.

Looking for reviews elsewhere online doesn’t reveal much, which might mean that Greenline Loans doesn’t do as much business as other similar companies.

While the lack of negative reviews might seem good, it could also suggest a lack of business activity.

It’s better to consider lenders with a proven track record.

Lawsuits

Checking if a business has been sued can show if it’s trustworthy.

While Greenline Loans hasn’t faced lawsuits, its parent company, the Lac du Flambeau leaders, was sued for charging very high interest rates.

In 2019, someone sued the tribe leaders for breaking their state’s rules on interest rates (Pennsylvania).

Suing a tribal lender is hard because they have legal protection, but suing the tribe is even harder.

The courts dismissed the lawsuit, saying the tribe could ignore state rules because of their legal protection.