Here are some more things to know about Advantage Auto Loans:

- They consider all types of credit histories, including people who need a loan after bankruptcy or repossession.

- If you work for yourself, you can still apply for a loan as long as you can prove your income.

- They’re open to people buying a car for the first time.

- Their lenders report your payments to credit agencies, which can help you build credit if you pay on time.

- If you still owe money on your current car, they can help you trade it in for a new loan, even if you haven’t finished paying for your current car. But be careful, as this could leave you owing more than your new car is worth.

Is an Advantage Auto loan right for you?

An Advantage Auto loan could work for you if your credit history is limited or you’ve had financial challenges like bankruptcy or repossession.

The company partners with many lenders and dealers, so they might find you financing, but the terms might not be the best.

For those with good credit, Advantage Auto could offer competitive interest rates through its partner lenders.

However, because there’s no prequalification option, you’ll have to apply formally, leading to a hard credit check.

This could affect your credit score while you’re still shopping for a loan.

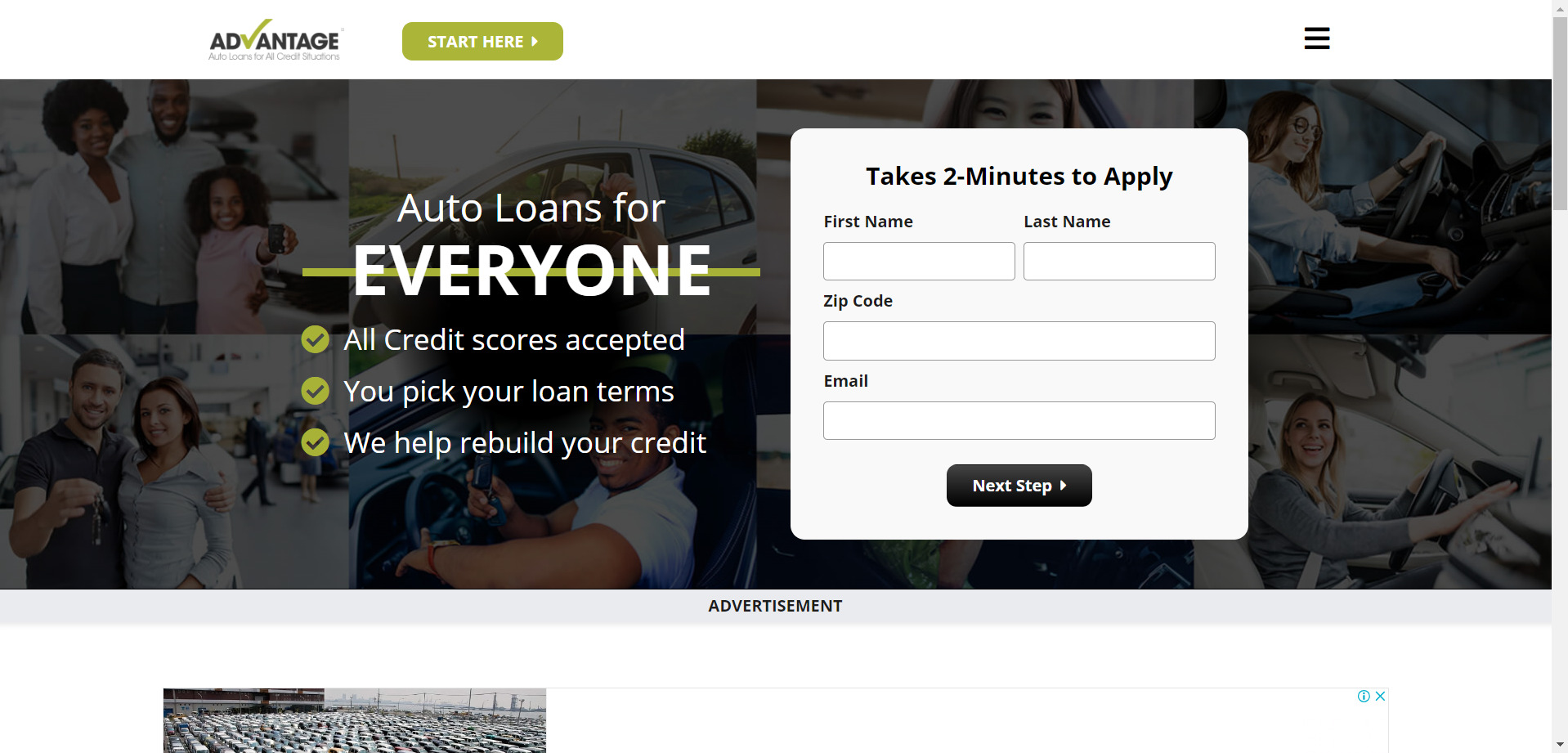

How to apply for a loan from Advantage Auto Loans

To get an auto loan from Advantage Auto Loans, you need to fill out their online form.

They don’t offer a way to see potential rates before applying, so it’s important to check your credit score first.

Lower scores usually mean higher interest rates.

Shopping around for loan offers can help you find the best rates and terms.

Is Advantage Auto Loans Legit?

Advantage Auto Loans has been in business for over 20 years and is a reliable auto loan service.

They only send your application to lenders you select, so there’s no risk in applying.

They have an A+ rating with the BBB, indicating their trustworthiness.

Plus, they offer free quotes on different types of loans.

Conclusion

In conclusion, Advantage Auto Loans is a legitimate choice for getting an auto loan.

They have a good reputation and have been in business for a long time.

While they don’t offer prequalification, they are a reliable option for those looking for auto financing.

Also Read: